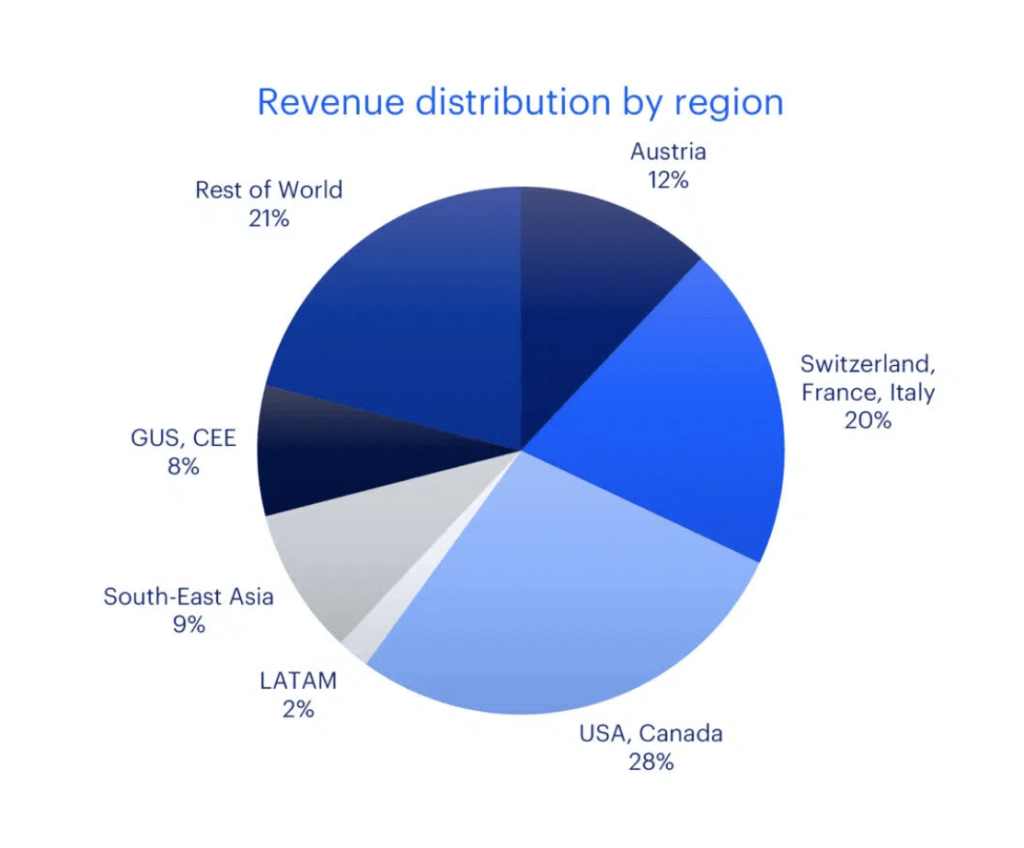

The Doppelmayr Group reported annual financial results today, and for the first time ever, North America surpassed Austria as the firm’s largest market. Doppelmayr reported total revenue of €946 million (US$1.0 billion) in fiscal year 2022-23, an annual increase of 6.7 percent and near a record high for the 130 year old company. The United States and Canada accounted for 28 percent or approximately $280 million during the fiscal year, which ran from April 2022 through March 2023. The last year before Covid North America represented only 17 percent of global turnover while the domestic Austrian market comprised 24 percent of the business.

The group delivered 104 ropeways globally in 2022-23, 30 of which landed in North America. US ski resorts reported a record 64.7 million skier visits last season and have 31 more Doppelmayr lifts under construction for the coming winter. “One of the reasons for this market development is the continuing attractiveness of outdoor sports,” noted the Doppelmayr Group annual report. “Many ski resorts are replacing outdated installations with modern ropeways in order to offer their guests enhanced comfort. In addition, the new lifts feature higher capacity to provide the growing numbers of visitors with rapid access to the ski slopes.” Doppelmayr went from installing just one D-Line detachable in North America in 2018 to five last year and nine this year. Doppelmayr also increased its global employee headcount to 3,335 full time equivalents, an increase of 5.7 percent. Part of that growth was the group’s acquisition of cabin manufacturer Carvatech last October.

Doppelmayr also reported a strong order book despite some economic headwinds. “The investment strength of ski area operators in North America remains at a very high level,” the company noted. The Alps market is also strengthening with three AURO autonomous gondolas under construction. On the urban front, Doppelmayr is working to build expansive gondola systems in both Paris and Mexico City. Doppelmayr also expects revenue growth from new products, including its clair software platform, upcoming TRI-Line 3S system and new 20-MGD D-Line.

Doppelmayr can’t be particularly privately held if they are announcing financial results publicly. Let alone data by region and other details that even public companies sometimes try to obscure.

That said, it is interesting how fast North America has grown, but also how spread across the world the business has become with 21% from projects so scattered that each is smaller than the LATAM call out already at a tiny 2%.

LikeLike

By privately-held I mean not publicly traded on any stock exchange. Not sure who exactly the shareholders are but I appreciate that they put out financial results even though they may not be required to.

LikeLike

It its probably you’re typical PE-backed group with the family still retaining some ownership as well as the executives if I had to guess.

LikeLike

Don’t forget they’re not an American company, and rules/common practise is definitely different over there.

I think part of it is that they use this as part of a marketing strategy. ‘Hey, here we are, this is what we do and where we do it, we’re particularly successful in this market, you should buy from us’. Privately-held companies in the US are definitely more secretive, for whatever reason.

LikeLike

(Doppelmayr Holding SE) is organized as a Societas Europaea and thus a publically traded company. It has to publish results, and you can also look up it’s owners in the Austrian firmenbuch, although the online services to do so will set you back a few Euros.

LikeLike