- Another real estate access lift called Powdercrest is on the horizon at Big Sky.

- The Whitetail Express at Whitetail, PA goes down until further notice after just one day of operation this season.

- Wildcat’s Snowcat lift, which missed all of last season, won’t reopen for a bit longer.

- A viral video from Austria shows gondola cabins surging up and down, blamed on speed and changed drive parameters.

- A grip slip incident claims a life in Montenegro.

- A skier is hospitalized after falling from a lift at Sunshine Village.

- Powderhorn performs a rope evacuation of the Flat Top Flyer.

- Following Washington floods, Crystal Mountain reopens at full capacity and Stevens Pass will open Monday with a four hour detour from Seattle.

- Workers at Le Massif, Quebec reject a contract proposal and authorize a strike beginning January 2nd.

- Eaglecrest’s used gondola project will cost at least five times initial estimates.

- A worker is seriously injured in Italy when wind lifts a safety net into the path of a chair.

- The sale of Eldora is taking longer than expected.

News

Facing a Strike, Telluride Announces Complete Closure

Nearly all of Telluride’s unionized ski patrollers voted to strike last night after weeks working without a contract. In response, Telluride Ski Resort says it plans to close entirely as of Saturday. “Due to the Ski Patrol’s unfortunate choice to strike, we have made the difficult decision to dose the resort on Saturday, December 27th,” the resort said on its website. “Currently, we have no idea how long their strike will last so we will continue to work on a plan that allows us to safely open again as soon as possible.” In recent weeks, the ski resort has been advertising for temporary ski patrol positions in the event of a strike. It also tried recruiting healthcare workers from Montrose with an offer of free season passes.

The United Mountain Workers union says it opted to strike only after months of negotiations reached an impasse. The previous contract with Telluride expired on August 31st. “Tonight, after painful consideration, the Telluride Professional Ski Patrol has authorized a work stoppage to begin Dec 27 with a 99% yes vote,” the union said on Instagram. “Despite extensive effort and movement from TPSPA to avoid this outcome, the company continues to push a 2.5 week old Last, Best and Final Offer that does not address our concerns. The $65,000 gap between 3 year proposals reflects unwillingness from the company to fix a broken wage structure. We need a pathway to attract and retain, and the current proposal from Telski is simply a bandaid, not a long term solution.” Telluride Ski Resort says it offered an immediate 13 percent wage increase for the 2025/26 season and a guaranteed minimum Cost of Living Increase of 5 percent in the 2026/27 and 2027/28 seasons.

Seven chairlifts were operating at Telluride as of this morning. The Telluride-Mountain Village Gondola is operated by the Town of Mountain Village and not expected to close. Telluride says all lift ticket and lesson products will be automatically refunded during the closure. Season passholders will also receive prorated refunds based on the number of days impacted. “We are actively working with our partners at Vail Resorts to develop a solution for guests who purchased Epic Pass products for their Telluride visit,” Telski noted.

News Roundup: Under Contract

- Challenger at Mount Snow is down due to mechanical.

- Two people are hospitalized after falling from the Mountaintop Express at Vail.

- Canyons Village Management Association says the outgoing Cabriolet will not move to replace Frostwood after all but it’s in talks to sell the Cab to another mountain.

- Lake Louise’s new map depicts the Richardson’s Ridge expansion.

- Quebec clears Mont-Sainte-Anne to reopen lifts ordered closed for inspection last week.

- Eaglecrest delays the opening of the summit Ptarmigan lift due to extended maintenance.

- Crystal Mountain, Washington will operate at limited capacity through January due to a road washout.

- British Columbia selects a new operator for closed Tabor Mountain.

- Telluride details where negotiations stand with its ski patrol union. Both sides plan to meet Saturday.

- The last segment of the first Bartholet Ropetaxi on demand gondola opened today.

- Also a remarkable new 3S in the Dolomites.

- Leitner opens its first Ropera next-gen detachable.

- MND’s first production Orizon detachable to be commissioned summer 2026 in Uzbekistan.

- ORDA may spend $3 million on a consultant to guide maintenance on more than $600 million in infrastructure.

- Loon Mountain formally seeks approval to build the Gateway pulse gondola.

- A new ownership group is under contract to purchase Hermon Mountain, Maine.

- The Royal Gorge, Colorado gondola to receive glass floors in 2026.

- Instead of replacing two lifts in 2026, Mt. Ashland will likely do Windsor in 2026 and Ariel for 2027.

News Roundup: Plan Maps

- Cuchara, Colorado plans to open a chairlift this season for the first time in 25 years.

- The New York Times check in on Killington’s efforts to modernize and compete with western resorts.

- Club Med to build on the Soleil side of Tremblant alongside “significant upgrades to the mountain.”

- Greater Paris joins the urban gondola club tomorrow.

- After millions of dollars and years of delays trying to install a gondola, Eaglecrest faces a $650,000 tariff bill and $450,000 cabin refurbishment bill amid questions whether the project should continue at all.

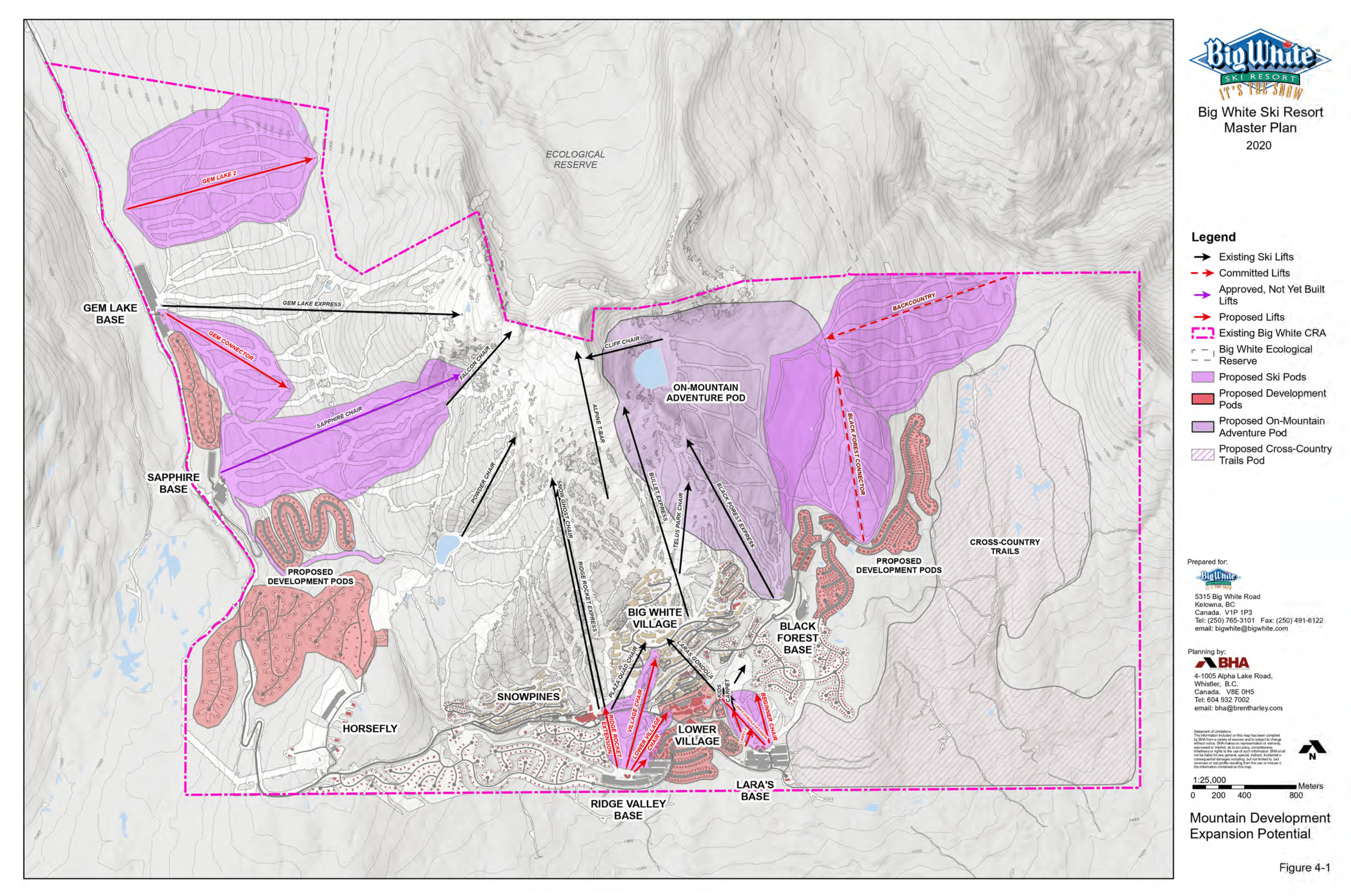

- Big White, BC amends its master plan to focus on the Backcountry expansion, Gem Lake 2 and infill lifts, shelving plans for East Peak and Gem Lake West.

- Telluride’s ski patrol votes down a contract proposal; could strike in the coming weeks. Telski owner Chuck Horning contends meeting the union’s demands would yield higher lift prices.

- Alberta designates Fortress, Castle and Nakiska its first designated all season resort areas targeted for development.

- Wachusett apologizes for another delay completing the new Polar Express.

- Ecosign’s Paul Mathews reflects on designing dozens of mountains and differences between the US and Canada.

- Big Sky is auctioning seats on Explorer Gondola’s first cabins for charity.

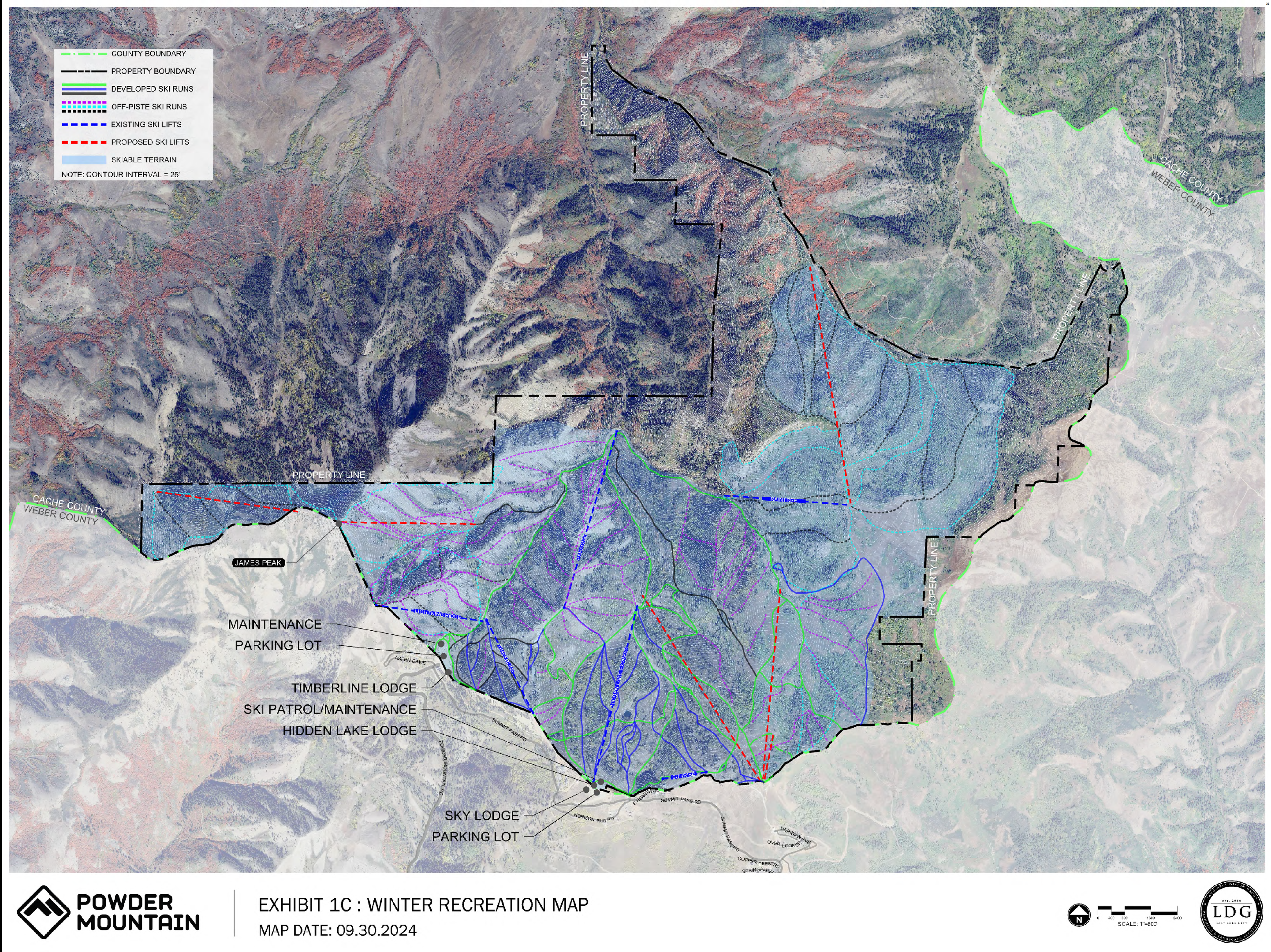

- Powder Mountain’s new trail map shows where the private Primetime detachable quad runs.

- Cache County approves Powder’s master plan for the northern half of the resort including two new lifts on James Peak and three near Cobabe Canyon.

News Roundup: Power Problems

- Crescent Hill, Iowa to install a new (used) drive terminal on its double chair.

- Approval of a new gondola in Hawaii may be rescinded.

- The private ski resort planned near Steamboat faces a mix of public backlash and support.

- Deer Valley President & COO Todd Bennett says several more lifts are planned for Deer Valley East, timeline TBA.

- Megève, France joins the Ikon Pass.

- Doppelmayr wins the tender to build a nine station urban gondola in Puebla, Mexico.

- Val Bialas, New York to reopen after several years closed.

- Lifts and ski trails return to Google Maps after a one year hiatus.

- A power outage leads to a rope evacuation at Sunburst, Wisconsin.

- Electric infrastructure problems will delay the start of Mont-Sainte-Anne’s season for at least another week.

- Skeetawk, Alaska seeks public funding for a second lift, possibly a gondola.

- Eaglecrest extends the bid deadline for a gondola general contractor, wants to open in 2028 but doesn’t have enough money to finish.

- Lost Ontario ski area Talisman to be preserved as conservation land.

- Aspen Mountain’s Nell Bell approval moves along.

- The New York Times spends a day with Snowbird’s mountain operations team.

- Holiday Mountain, New York sends a Poma bullwheel and gearbox to help Whaleback, New Hampshire revive its chairlift.

- Welch Village, Minnesota’s new quad is named Joy Ride.

- Spirit Mountain’s new trail map shows where the Highline Quad runs.

- Toronto Zoo’s SkyPod to open in 2027.

- Leitner-Poma and Skytrac celebrate completing 20 lifts on time or early.

- Pico to auction 1965 Bonanza chairs for charity.

- Bear Mountain, California purchases new Skytrac chairs for Lift 7.

News Roundup: Interior BC

- Powdr sells SilverStar, BC to Pacific Group Resorts.

- Excavation begins for the Okanagan Gondola in interior BC.

- A study finds the proposed Zincton project in BC could disrupt grizzly and wolverine corridors.

- Little Switzerland, Wisconsin plans to replace the up-and-over 1-2 lift with two quads in 2026.

- Fall Line Construction’s new website showcases several cool lift projects from the past few years.

- Mad River Glen may acquire 1,100 acres of surrounding land.

- Telluride and its unionized ski patrol remain far apart with a strike possible.

- Compagnie des Montagnes de Ski du Quebec (CMSQ) would like to own ten ski areas in five years.

- Nearly a year since the province of Quebec and Resorts of the Canadian Rockies announced a CA$50 million joint investment at Mont-Sainte-Anne, the deal still hasn’t been signed.

- The Canadian Ski Museum highlights community ski area history in every province.

News Roundup: Canadian Retirements

- The town of Nederland, Colorado expects to close its purchase of Eldora before the end of the year for $115 to $120 million.

- Park City’s new map shows the soon-to-open Sunrise Gondola.

- Loon Mountain drops an all-new Rad Smith map showing a future pulse gondola.

- The CTEC 2 quad disappears from Paoli Peaks’ trail map.

- Searchmont, Ontario retires the Quad lift; eyes a longer replacement.

- Marble Mountain, Newfoundland won’t operate Black Mariah or Newfie Bullet this season; may remove them.

- Telluride begins hiring temporary patrollers to prepare for a possible strike.

- Black Mountain files a federal lawsuit against the town of Jackson, New Hampshire over a liquor license revocation.

- Here’s a detailed Deer Valley East construction update.

- SE Group’s Chris Cushing joins the Ski Utah podcast; shares the only alignment from Deer Valley’s original master plan with no lift yet.

- Hatley Point, North Carolina eyes building a base-to-summit six pack; reactivating Breakaway and Beginner in 2026.

- Whitecap Mountains, Wisconsin files for bankruptcy, plans to continue operating during reorganization.

- Doppelmayr’s latest UP magazine highlights several projects at Lake Louise and more.

News Roundup: Conical Towers

- Hickory, New York closes.

- Steel erection begins for the only lift in Arkansas.

- Cannon’s new map shows no more tram.

- Steel and aluminum tariffs increase the cost of certain maintenance projects on the Telluride-Mountain Village gondola by 50 percent.

- Vail CEO Rob Katz reiterates his company’s desire to build new Eagle and Silverlode lifts at Park City.

- A wildlife reserve in Kentucky plans a three station sightseeing gondola.

- Sir Sam’s, Ontario retires the Red Rocket and Eagle View doubles.

- The Los Angeles City Council votes 12-1 to oppose a Dodger Stadium gondola.

- MND hires a Director of Ropeways for North America.

- Snowland, Utah eyes building a T-Bar or J-Bar next summer with $1.46 million in state grant money.

- Unionized patrollers at Breckenridge and Eldora ink new contracts; negotiations continue at Telluride and Whitefish.

- A rider falls from the Montezuma Express at Keystone.

- Whitecap Mountains, Wisconsin could go to foreclosure auction on December 2nd.

- Enjoy these Argo progress photos from reader Munier S.

News Roundup: Gondola Tax

- Ragged Mountain, New Hampshire is sold to local investors, will no longer be operated by Pacific Group Resorts.

- Voters in Mountain Village, Colorado enact a 5 percent tax on Telluride lift tickets starting next week to fund gondola construction, operations and maintenance.

- The Texas Parks & Wildlife Foundation launches a multi-million dollar fundraising effort to finish replacing the Wyler Aerial Tramway in El Paso.

- Sugarbush intends to operate the Slide Brook Express this winter after it missed last season.

- Honolulu’s City Council passes a resolution opposing construction of a sightseeing gondola on the island.

- A study finds Utah’s ski industry generated $2.5 billion in spending last season, directly supporting 31,800 jobs.

- Angel Fire’s new map shows off an all-new lift alignment.

- Big Sky’s fresh map depicts the new, curved Explorer Gondola.

- Mount St. Louis-Moonstone shows where its fifth detachable runs.

- Compagnie des Montagnes de Ski du Quebec (CMSQ) to operate Massif du Sud, its fourth Quebec ski area. Planning is underway for a base-to-summit detachable.

- Camp 10, Wisconsin remains unsure about the future of the Red T-Bar, damaged by an October fire and uninsured.

- The first Doppelmayr TRI-Line gondola is commissioned and ready for winter.

- Saskadena Six retires Chair Two, may build a new lift in the future.

News Roundup: Apple Harvest

- The Doppelmayr Group to merge its Frey AG Stans and Garaventa units in Switzerland.

- Four Seasons, New York closes for good to be redeveloped.

- Both the Denver Post and Colorado Sun cover growing local frustration with Telluride’s owner over gondola funding, snowmaking, labor relations and alleged personal conduct.

- Powder Mountain works to build out private skiing while maintaining a public ski resort next door.

- The former owner of closed Spout Springs, Oregon is found liable for the cost of removing improvements from Forest Service land.