- Bretton Woods’ new map shows where the new BEQII goes.

- The new Bryce Resort map shows a backside expansion.

- Lutsen gets a new trail map by VistaMap.

- Deer Valley mountain operations leadership joins Doppelmayr on the Ski Utah podcast to preview the East Village expansion.

- Mont Gleason, Quebec plans to replace the Laurent-Lemaire quad soon.

- Anakeesta to replace its fixed-grip chondola with a detachable.

- The State of Texas to hold a press conference next week announcing the next steps in the Wyler Aerial Tram replacement project.

- It’s the final weekend for the Cannon Tramway with the last trip at 4:45 pm Sunday.

- Red Lodge Mountain details several modifications made to its Triple Chair over the summer due to a fatal deropement last spring.

- Ikon adds nine mountains in Japan, South Korea and China.

- Holiday Mountain offers up classic Poma double chairs.

- Whaleback, New Hampshire expects to lose $300,000 this winter without its chairlift; seeks to raise $210,000 by December 1st to open.

- Powder Mountain installs artwork on several lifts including a neon piece on the Paradise Express, flagpole on Timberline and colorful canopy on a conveyor.

- MND wins a tender to build an energy-neutral aerial tramway on the island of Réunion in the Indian Ocean.

News

Steelhead Systems Responds to Ski Bluewood Lawsuit

British Columbia-based Steelhead Systems Inc. (SSI) has responded to a lawsuit filed by Ski Bluewood, Washington over a delayed lift project. As I detailed last month, the two parties initially agreed to bring a used detachable quad to Bluewood in June 2024. The 1993 Doppelmayr lift would replace a base-to-summit triple chair and dramatically reduce ride time. SSI would act as a broker between Pro-Alpin Ropeway Services of Austria and Bluewood, bringing the lift from Sölden to Washington at significant saving versus a new lift. SCJ Alliance would engineer the lift and Bluewood would complete much of the installation work itself. Bluewood announced in late June 2024 the lift was expected to open for the 2025-26 season.

The deal soured this summer when disagreements arose over shipping costs, timelines, the number of shipping containers needed, exchange rates and more. In its claim filed in the Supreme Court of British Columbia, Bluewood alleged breach of contract, negligent misrepresentation and unjust enrichment by SSI. In its Response to Civil Claim, SSI’s attorney denies many of Bluewood’s claims, including that shipping costs and exchange rates were fixed upon contract signing. SSI alleges only after Bluewood stopped making payments did it stop shipping containers across the Atlantic. “Pursuant to [the agreement], all responsibility and risk with respect to the equipment, including transportation, rests with the Buyer,” the filing notes. “This responsibility includes any changes to shipping costs or exchange rates, which are matters outside the control of the Defendants.” SSI argues three outstanding invoices total $587,548.

SSI also alleges its principal, Zrinko Amerl, told Bluewood in 2024 that fall 2025 completion was an optimistic timeline. The complaint alleges Bluewood failed to provide accurate survey data in a timely manner. Steelhead Systems says SCJ Alliance’s engineer requested a 16th tower, which SSI agreed to provide at below market price. Finally, SSI alleges “ProAlpin insisted that there be a garage system put in place for maintenance and storage of chairs, however [Bluewood] refused to follow this recommendation.” On October 26th, I received word that SCJ did not request a 16th tower and that line was in the process of being corrected in the Response to Civil Claim.

To date 23 containers have been delivered to Bluewood containing chairs, terminal elements and towers. Four containers’ worth of equipment remains in Austria. Alarmingly, Pro-Alpin indicated to SSI that all remaining parts, including bullwheels and the haul rope, not picked up by September 8th, 2025 would be scrapped. “As of today’s date, SSI is unaware if any action has been taken with respect to this,” the filing notes.

Shortly after filing the response, SSI countersued Bluewood’s owners, alleging the lawsuit, associated press release and media coverage have damaged its reputation. The filing specifically mentions Lift Blog’s coverage and reader comments impacting SSI’s ability to sell lifts within the broader mountain resort industry. “As a result of the defamatory statements made by [Bluewood], SSI has suffered and continues to suffer losses to its business,” the suit says, alleging statements made by Bluewood will cause an estimated loss of approximately $10 to $15 million in revenue. The company seeks payment of outstanding invoices plus interest, damages and other costs.

Bluewood officials declined to comment beyond their initial press release, citing pending litigation. The ski area has been busy re-hanging chairs on the Skyline Express, the 1978 Borvig once set to be replaced.

News Roundup: Chairlift Ban

- A ranch in Hawaii scales down its proposed gondola in hopes of allaying community concerns. Even so a State Representative plans to introduce a bill to ban chairlifts and gondolas from ever being constructed in Hawaii.

- A lightning-caused fire burns the drive terminal of Camp 10, Wisconsin’s Red T-Bar.

- Mountain High revives the Discovery lift damaged in a 2024 wildfire.

- Alterra introduces Reserve add-on passes with line cutting privileges and other perks at Big Bear, Blue Mountain, Crystal Mountain, Solitude, Sugarbush and Tremblant.

- Thousands of Crystal skiers aren’t happy about the Reserve Pass.

- Steamboat takes another step toward a detachable base area transit gondola.

- Hermon Mountain, Maine will close after this season if a buyer can’t be found.

- Hickory, New York leaves Indy Pass.

- Skytrac commissions its on-site wind turbine.

- Waterville Valley shares a wild picture of bubble chairs during a fall winds and a T-Bar construction update.

- Deer Valley unveils its 25-26 trail map depicting eight new lifts.

News Roundup: Upset

- Poma France introduces LIFE terminals equivalent to Leitner’s new ROPERA.

- Italian manufacturer Graffer wins tenders to build its two detachable lifts utilizing technology from Turkish manufacturer Anadolu Teleferik.

- Despite the new projects, Graffer’s owner says he’s not trying to take on Leitner and Doppelmayr.

- The Toronto Zoo nears a deal with a private company to build a short gondola.

- Sunrise Park, Arizona leaves Indy Pass.

- The Forest Service seeks public comment on Keystone’s proposal to replace A-51 with a detachable quad.

- Forest Service staffing cuts slow projects approvals, shift work to outside consultants.

- The Port Authority of New York and New Jersey breaks ground on a $3.5 billion automated people mover powered by Doppelmayr tech.

- Timberline Lodge outlines an extraordinary rise in insurance costs leading to price increases.

- Friends of Little Cottonwood Canyon argues escalating costs make a canyon 3S unfeasible.

- Vail Resorts CEO Rob Katz revives his podcast about the company.

- Tijuana, Mexico to jump on the urban gondola bandwagon.

- Sponsored job: Electrician at Jackson Hole Mountain Resort

News Roundup: Can’t Just Be About Lifts

- An updated Stratton master plan envisions a competition T-Bar in 2027, a hotel-to-base chairlift in 2030 and gondola replacement circa 2033.

- Los Angeles releases the Draft Supplemental Environmental Report for the proposed Dodger Stadium gondola.

- The Forest Service approves Vail’s proposed replacements for lifts 15 and 21.

- Spirit Mountain’s new Leitner-Poma quad to be called Highline.

- Asked about new lifts on the Vail Resorts earnings conference call, CEO Rob Katz tells analysts priorities lie mostly elsewhere:

“We’re always going to be upgrading lifts; we announced a new lift for next year and that’s critical. But I think we need to realize also as a company and as an industry that it can’t just be about lifts. It’s not the only thing that matters to people. And in our minds we think there’s technology that can make a big difference. How people use technology in the digital experience, how it makes it easier for them to rent skis, how it makes it easier for them to connect with their ski instructor, how it makes it easier for them to get food, how it makes it easier for them to get around a resort or overall book a vacation. I think these are all things that are critical that really speak to the entirety of the guest experience when they come to us. Those are things where we really have a unique advantage because we own and operate all our resorts. They’re all on a common platform. And it’s where you invest dollars that actually impact everyone’s experience with all of our resorts rather than a singular lift, which affects one resort for some people who use that lift. Now that said, we have to keep investing in lifts. When you look back historically, you’ve seen us spend a lot of money on lifts over the last four years. So that’s continuing. We’re still going to keep proposing lifts. But I think the differentiator is going to be in this other area which is not as capital intensive as trying to replace every lift on Vail Mountain or something like that. That’s where we’re putting our focus.”

- A Swiss resort Vail was said to be interested in, Flims Laax, to be purchased by local municipalities.

- Some cool pictures of the nearly complete Mighty Argo Cable Car.

- A BC indigenous group acquires additional land for the proposed Cascade Skyline Gondola.

- BigRock, Maine introduces a new trail map painted by Rad Smith.

- Part of the former Iron Mountain Ski Area near Kirkwood goes up for sale. A reader who’d like to remain anonymous sent along these recent photos of five abandoned lifts.

Vail Resorts Eyes Park City Lift Projects in 2026 and 2027

Vail Resorts today released its fiscal 2025 fourth quarter and full year earnings report, including updates on pass sales, cost cutting and capital improvements. Net income for the year ended July 31st rose 21 percent to $280 million compared with $231.1 million a year earlier. Resort Reported EBITDA landed at $844.1 million compared to $825.1 million for fiscal 2024, an increase of 2 percent. On the less bright side, pass product sales for next season declined 3 percent in units and rose just 1 percent in dollars through September 19th despite a 7 percent price increase. The Company provided an outlook for fiscal 2026, expecting net income attributable to Vail Resorts, Inc. to decline to between $201 million and $276 million and Resort Reported EBITDA to fall between $842 million and $898 million. In a subsequent release, Vail announced the departure of two longtime board members. Vail Resorts’ share price has fallen roughly 15 percent year to date and declined 2 percent after hours upon the earnings release.

“The results from this past season were below expectations and our season-to-date pass sales growth has been limited,” noted Rob Katz, Vail’s newly-returned CEO. “We recognize that we are not yet delivering on the full growth potential that we expect from this business, in particular on revenue growth, in both this past season and in our projected guidance for fiscal year 2026. However, we are confident that we are well positioned to return to higher growth in fiscal year 2027 and beyond.” Vail acknowledged an outsized focus on email for attracting guests and a drive toward season pass sales at the expense of lift ticket revenue. “Our approach to engaging with guests has not kept pace with shifting consumer behaviors and as a result, we have not been able to fully capitalize on our competitive advantages or adapted our execution appropriately to respond to shifting dynamics,” Katz said. “While email was for many years our most effective channel, its impact has declined significantly in recent years, and we’ve been slow to shift to new and emerging marketing channels. We also believe we need to shift more focus to marketing our lift ticket business, which has not received the same level of focus, creativity, and resources as pass penetration increased.” Commenting on recent pass sales, Katz noted the company is seeing lower renewal rates from less-tenured passholders and fewer new passholders. Renewal rates are better for people who’ve held a pass for many years. ” We continue to see long-term opportunity to further expand the reach of our pass program,” Katz said.

Vail is largely on track with its resource efficiency transformation plan announced a year ago. At the time, the company planned to achieve $100 million in annual cost savings by fiscal 2026 through scaled operations, global shared services and expanded workforce management. It achieved $37 million in savings for fiscal 2025 and plans $75 million in savings in fiscal 2026. Vail plans to exceed $100 million in efficiencies in fiscal year 2027.

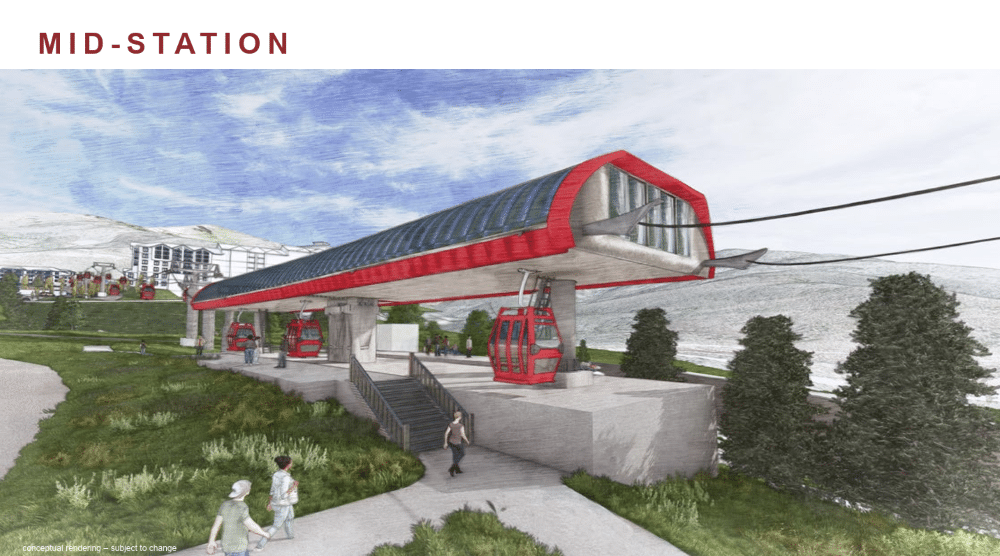

Vail traditionally announces new lift projects and key capital priorities for the following year in September. This go around Vail affirmed its commitment to build a new Canyons Village gondola in 2026, replacing the aging Cabriolet. Subject to approval, the 10 passenger gondola will include a mid-station to service the middle village and will also serve the new Canyons Village parking structure, set to open this winter. “This new gondola will provide an upgraded arrival experience to the resort and complement the Canyons Village Parking Garage, a new covered parking structure with over 1,800 spaces,” said Vail. Vail Resorts and the Canyons Village Management Association will split the cost of the village gondola, similar to the nearly complete Sunrise Gondola by Leitner-Poma.

Notably Park City plans to resubmit plans to replace Eagle and Silverlode, projects sidelined in 2022 over a process dispute. If approved, the six-seater Eagle and eight-seater Silverlode would be constructed in 2027. Vail sent the original Doppelmayr equipment for these lifts to Whistler Blackcomb in 2023 and 2024 so the project will need to be contracted anew.

The only other capital projects Vail announced across its 42 resorts was a hotel renovation at Vail and additional functionality in the My Epic App. There certainly are other needs, however, and additional projects could be announced with Vail’s next earnings in December.

News Roundup: Bonus Mountains

- Snow Partners and Mountain Collective form an alliance, offering discounts on each other’s multi-mountain products for passholders.

- Snow Triple Play adds Kissing Bridge, NY to its partner lineup.

- Ikon Pass signs three more mountains to the two day bonus tier: Grouse Mountain & SilverStar in BC and Ski Butternut in Massachusetts (full Ikon only, subject to blackout dates.)

- The Black Mountain Community Corporation completes land acqusition and seeks initial accredited investors.

- Investors in Burke Mountain’s EB-5 projects will get only 36 percent of their principal back as part of the mountain’s sale.

- Cannon Mountain partners with SCJ Alliance to perform structural analysis on the soon-to-close aerial tramway and determine what components could be re-used on a new tram.

- A jury finds the Glenwood Caverns Adventure Park and a drop ride manufacturer liable for $205 million after a child’s death; the gondola-accessed park says “the size of the total jury verdict award puts the existence of Glenwood Caverns at serious risk.”

- Camelback removes two chairlifts from its trail map: Marc Antony and Cleopatra.

- Amid removal rumors, I asked Hunter Mountain about D-Lift and the Highlands Poma. GM Trent Poole shared the following:

“We’re in the process of removing the D-Lift. Thanks to last year’s Epic Lift Upgrade – the new Broadway Express – our updated lift infrastructure provides faster, more efficient access than what D-Lift provided, and similar terrain can be accessed at Hunter North via the Northern Express. At this point, the lift is both redundant and outdated, and the time and resources needed to revive this lift are better focused where guests will see a positive impact to their experience on mountain, like our snowmaking upgrades.

The Highlands Poma is something our team has discussed as part of long-term planning. We’re always exploring ways to enhance the guest experience, and that lift remains part of the broader conversation. For now, our focus is on showcasing the significant upgrades we’ve already delivered—Broadway Express, Otis, and automated snowmaking additions—along with maximizing the terrain available on Hunter North, West, and East. It’s also worth noting that Hunter is the only ski resort in New York to feature three high-speed six-passenger lifts: Northern Express, Katskill Flyer, and Broadway Express. For now, we’re confident in the strength and efficiency of our current lift system.”

- A lift and parking expansion pops up the Forest Service system for Lost Trail, Montana.

- White Pass to sell and auction Riblet double chairs.

- A mechanic is killed after becoming entangled in terminal machinery in Switzerland.

- Grand Junction’s newspaper catches up with a busy Leitner-Poma.

- The first urban gondola in the Paris region to open December 13th.

- More than 5.4 million people rode Mexico City’s Cablebús Line 3 in the first year of operation.

- Vermont’s Brattleboro Ski Hill seeks donations to continue offering $5 lift tickets to the community and upgrade controls on its 1964 T-Bar.

- Eaglecrest begins gondola road construction and issues an RFP for a general contractor:

News Roundup: Superstar

- The death toll rises to three in last week’s Mt. Elbrus deropement with the CEO and head technician detained by the Russian government.

- Dramatic video emerges from last month’s failure of another Russian single chair not far away.

- 49° North to replace its beginner chairlift with a Doppelmayr quad next year.

- In an interview, Garaventa’s CEO discusses US tariffs on Switzerland, competition with HTI and more.

- Indy Pass adds Donner Ski Ranch, California; Magic Mountain, Idaho; Montage Mountain, Pennsylvania (returning after a brief hiatus) and Leavenworth Ski Hill, Washington plus mountains in Austria and Turkey.

- Ecosign releases a book highlighting 50 years of mountain planning.

- Crystal Mountain’s summit webcam captures a slight mishap during installation of Rainier Express’ top terminal (all is well, it’s now assembled.)

- Welch Village to sell Hall double chairs next week.

- Spirit Mountain asks the public to vote on 13 possible names for its new chairlift.

- Chelan County releases its draft environmental impact statement for the proposed Mission Ridge expansion.

- Construction is well underway on Arkansas’ only chairlift.

- Stagecoach Mountain Ranch moves toward approval outside Steamboat.

- Hesperus, Colorado to remain closed this season.

- Sommet Saint-Sauveur adds a loading conveyor to the Sommet Express.

- The chairlift at Whaleback, New Hampshire may miss this season.

- Enjoy a few construction photos from Killington (both the Superstar replacement and Skyeship cabin upgrade.)

News Roundup: Chinook

- Kicking Horse’s gondola reopens after a six month closure with new hanger arms.

- Vail Resorts might announce new lift projects on Monday, September 29th with fiscal year end earnings.

- Arizona Snowbowl to use gondola cabins as dining rooms for five course dinners on select nights.

- Colorado Mountain College in Leadville to reinstall Steamboat’s former Rough Rider platter as a training lift.

- Purgatory postpones construction of the Gelande lift to next summer, citing permit delays.

- Mt. Bachelor will upgrade the Northwest Express next summer with new operator houses, controls, a night drive system and expanded parking.

- Alterra outlines $400 million in improvements for this season.

- A Doppelmayr gondola station is set on fire in Nepal as part of widespread protests.

- Doppelmayr’s first vertical RopeCon material ropeway to be built somehwere in the Americas.

- The bottom terminal for Alpental’s new Chair 2 is set by Chinook helicopter.

- Aspen receives county approval to build the Nell Bell detachable quad next summer.

- America’s first Bike Cab gondolas arrive in Colorado.

- Two people are killed when a chairlift de-ropes on Russia’s Mt. Elbrus. Videos show challenging conditions for a rope evacuation.

- Lake Louise’s Richardson’s Ridge expansion to open early spring 2026, eventually will include a surface lift from Temple Lodge.

- Doppelmayr reports a 13 percent increase in revenue for fiscal 2024-25, completing 93 ropeways in 25 countries. Approximately 24 percent of €1.2 billion in turnover came from the US and Canada.

- Doppelmayr also reveals a contract to replace a Poma-Otis automated people mover at the Getty Museum in Los Angeles.

- The new gondola at Hawks Nest State Park in West Virginia nears completion.

News Roundup: In the South

- Timberline begins the NEPA process for a gondola from Government Camp to Timberline Lodge, requiring less than one acre of new permit area.

- West Virginia opens the first of two Doppelmayr gondolas in State Parks.

- A paraglider survives being caught in a moving gondola in Switzerland.

- Leitner’s apple ropeway opens in Italy.

- A funicular railway crashes in Portugal, killing 16 people, with the investigation focused on the wire rope.

- Leitner-Poma and Skytrac’s parent company invests in HKD Snowmakers; will consolidate DemacLenko and HKD in North America.

- A gondola to Disneyland is floated in Anaheim with unproven technology called Whoosh.

- The last day for Cannon Mountain’s tram will be October 26th; it’ll continue running for administrative purposes.

- Black Mountain, New Hampshire reports its highest skier visits ever but also growing pains with noise complaints from neighbors.

- The Okanagan Gondola previews the view from the top of the upcoming sightseeing lift.

- Killington’s former Sunrise lodge and base of the Northeast Passage triple are for sale.

- Homewood commences gondola construction.

- Here’s what happens to a glacier-pinned lift when the glacier recedes.

- Powder Mountain walks back its map showing DMI being installed for 2026-27.