- Powdr sells SilverStar, BC to Pacific Group Resorts.

- Excavation begins for the Okanagan Gondola in interior BC.

- A study finds the proposed Zincton project in BC could disrupt grizzly and wolverine corridors.

- Little Switzerland, Wisconsin plans to replace the up-and-over 1-2 lift with two quads in 2026.

- Fall Line Construction’s new website showcases several cool lift projects from the past few years.

- Mad River Glen may acquire 1,100 acres of surrounding land.

- Telluride and its unionized ski patrol remain far apart with a strike possible.

- Compagnie des Montagnes de Ski du Quebec (CMSQ) would like to own ten ski areas in five years.

- Nearly a year since the province of Quebec and Resorts of the Canadian Rockies announced a CA$50 million joint investment at Mont-Sainte-Anne, the deal still hasn’t been signed.

- The Canadian Ski Museum highlights community ski area history in every province.

Powdr

Town of Nederland, Colorado to Buy Eldora

The Colorado town located closest to unincorporated Eldora Mountain Resort plans to purchase the mountain from Powdr Corporation by October. A signed term sheet comes after months of negotiation and work behind the scenes between Powdr and the Town of Nederland. Powdr will continue to operate the mountain for two years until a “coalition of Front-Range ski industry veterans” takes over. The town plans to quickly add summer activities, a first for the 63 year old mountain. “Nederland aims to turn Eldora into a year-round, community-driven asset– expanding recreation, sparking local jobs and outdoor industries, and weaving sustainability and social equity (i.e. workforce housing) into every run, trail, and event,” said an announcement from Nederland’s Board of Trustees. “These economic development opportunities will give the Town a long-needed, sustainable way to fund infrastructure.” Eldora will remain partnered with the Alterra-owned Ikon Pass as it has been since Ikon’s inception in 2018.

Eldora is one of five mountains Powdr placed on the market last summer. Killington and Pico in Vermont sold to a local ownership group while Mt. Bachelor, Oregon was eventually pulled off the market in April. SilverStar, British Columbia remains for sale. Powdr always planned to retain Boreal and Soda Springs in California; Woodward Park City and Snowbird in Utah as well as Copper Mountain, Colorado.

Once the Eldora acquisition is complete, Nederland plans to annex the ski area, which operates partially on private land and mostly in the Roosevelt National Forest. Annexation could add $1-2 million in annual tax revenue to the town’s general fund. Eldora’s 700 staff will eventually become municipal employees, offering new benefits to them. “To the Powdr team: Thank you for stewarding the mountain thus far,” wrote the town trustees. “We take our responsibility seriously and we are forever thankful for your belief in us to continue your legacy.”

The town plans to issue municipal revenue bonds backed by the resort’s earnings, not tax revenue for the purchase. The total sale price remains confidential. The mountain is profitable though and projections show the town could build a $10 million reserve in the first few years of ownership. “The Town will also be exploring opportunities for grants and private-sector dollars to help lower the total debt,” an FAQ noted. The sale is expected to close by the beginning of October if everything goes smoothly.

News Roundup: Contingency Plan

- Homewood to reopen next season but its D-Line gondola delivered in 2023 won’t be installed this summer.

- Powdr abandons plans to sell Mt. Bachelor.

- Powdr’s sale of Eldora is said to be in the final stages.

- Le Massif, Quebec signs on to the Ikon Pass.

- New details emerge from the antitrust case against the owner of Song Mountain and Labrador Mountain, New York; he plans to appeal.

- Whaleback, New Hampshire looks toward a new chairlift.

- Sun Valley seeks to be removed from a lawsuit filed by a homeowner regarding the placement of the new Flying Squirrel quad.

- Stratton’s American Express closes early and will reopen for summer later than normal for a major systems modernization.

- The Forest Service approves Steamboat to replace Sunshine Express with a six pack.

- The world’s second largest gondola network is proposed in India with 15 stations and 660 cabins.

- If Bluewood, Washington can’t complete its planned relocation of a used high speed quad from Austria next season, it will keep its Borvig lift and credit passholders $100.

- The US government implements a blanket 20% tariff on goods from the European Union and 31% on products from Switzerland, both major source regions for lift components.

- Skeetawk, Alaska works to repair its only chairlift but snow may run out first.

- Arctic Valley, Alaska’s T-Bar will be inoperable the rest of the season due to an incident damaging the haul rope.

- Holiday Mountain, New York looks to reopen long lost terrain with a third chairlift.

- Alta to realign Supreme this summer, re-doing every foundation and re-using towers and terminals.

- Castle Mountain’s expansion lift to be called Stagecoach Express.

- The owner of Berkshire East and Catamount would operate Burke Mountain under a proposed sale to local investors. The group also plans to refurbish the J-Bar and relocate Willoughby if the sale goes through.

Killington to Replace Superstar Express and Upgrade Skyeship Gondola

The sale of Killington and Pico to local investors has closed and today the group announced their initial tranche of capital investments. Over the next 12 to 16 months, Killington plans to spend roughly $30 million to build a Superstar Express six pack, add 1,000 HKD low energy new snow guns and replace all 116 Skyeship Gondola cabins. Skyeship’s cabin storage facility will also be replaced in the near future. The current Superstar lift is the oldest detachable chairlift in New England, dating back to 1987 (tied with two other lifts at Killington/Pico and the Grand Summit Express at Mount Snow.)

The news comes just over a month since Powdr announced the sale of Killington and listing of three other resorts. “Over the next 10 years, our goal is to reinvest all the profits the mountain creates,” said Michael Ferri, one of two lead investors in Killington Independence Group, LLC, comprised of 16 total investors. “[Profits] will stay here in Vermont, they will stay here at Pico and they will stay here at Killington,” said Ferri.

Surprisingly after 37 straight lifts from other manufacturers, Killington selected Doppelmayr to construct the new Superstar Six. Unlike Killington’s Snowdon Six, the new lift will not feature bubbles. “There are a number of factors, but this lift is a relatively short ride which makes having bubbles on the lift less impactful, especially considering the added complexity of needing a storage barn for overnight storage of bubble chairs,” said Killington. Superstar has one of the longest winter operating schedules in the country, spinning for World Cup ski racing in November all the way until the end of the season in May or June. “The Superstar lift replacement will affect spring skiing this season and potentially the 2025 Stifel Killington Cup, noted Killington President and CEO Mike Solimano. “We do plan to make more snow in North Ridge to extend the season in the Canyon this year and are working with the lift manufacturer to finalize the construction plan for the lift before making the call on the Killington Cup,” he continued.

Leitner-Poma will supply new cabins for Skyeship, the same Diamond model the K-1 Gondola received in 2018. “Many of our current operational challenges with [Skyeship] can be attributed to the older cabins,” noted Killington. “The challenges are exasperated by not being able to store the cabins in a heated building causing door opening and closing mechanisms to become frozen overnight.” All of these improvements are slated for the next two years with more expected to follow over the next decade.

News Roundup: Sold Out

- Mexico City and Leitner inaugurate a new urban gondola line with 283 cabins and 7 stations.

- Leitner-Poma looks to hire a Sales Manager specifically for urban ropeways in North America.

- Leitner, Poma and Bartholet parent company HTI reports a record €1.3 billion in revenue for fiscal 2022.

- A skier dies after falling through a gondola cabin window in France.

- With its gondola back in operation, Mont-Sainte-Anne eyes a $100 million renewal with bids already received for two lift replacement projects.

- Doppelmayr revitalizes a 110 year old cable car over Niagara Falls.

- The Indy Pass suspends sales due to capacity limitations at partner resorts.

- Eagle Point teases multiple lift upgrades including a new connector chair.

- Powdr sells Lee Canyon to Mountain Capital Partners.

- Taos confirms Leitner-Poma will build new chairlifts on both sides the mountain this summer.

Mt. Bachelor to Replace Idled Skyliner Express

The second six place chairlift in Oregon will debut for the 2023-24 ski season, Mt. Bachelor and parent company Powdr announced today. The larger detachable will increase capacity by 50 percent from the current Skyliner Express, which debuted in 1989 and has remained out of service this season due to technical issues. Mt. Bachelor and Doppelmayr will repair the aging high speed quad for the coming 2022-23 season before replacement begins a year from now.

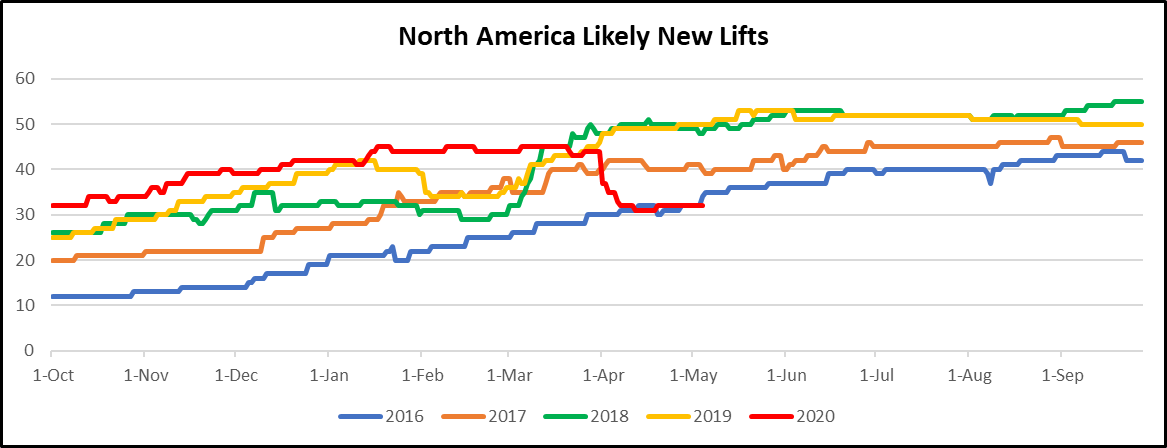

“Since Skyliner went out of service the team and I, together with Powdr have been working parallel paths, first to try to get the lift repaired for the current season and second to either replace or repair the Skyliner lift in time for next winter,” noted President and General Manager John McCleod in a blog post. “As it turns out, we are going to do both,” he continued. “If there had been any way that we could have replaced Skyliner with a six-pack over the coming summer we would have done it, however by the time we began talking to lift manufacturers in January their production and installation schedules were fully committed for 2022.” The Lift Blog 2022 project count stands at 56 with 35 of those being new detachable lifts across North America.

Exact specifications for the new Skyliner are yet to be determined but it will become the largest lift investment in Mt. Bachelor’s history. A manufacturer was not publicly announced and Mt. Bachelor did not immediately respond to a request for comment on that.

News Roundup: Forecasting Demand

- Washington’s Mission Ridge buys Blacktail Mountain, Montana.

- Bousquet intends to replace the Blue chair with a quad in the next two to three years.

- A gondola is proposed to cross between Kansas and Missouri.

- Bromont adds loading conveyors to two fixed quads; Sun Peaks upgrades Crystal with one too.

- Rusty Gregory says Ikon Pass sales are growing at a faster rate than any previous selling season.

- Vail Resorts will limit ticket sales during holidays, introduce lift line wait time forecasts and devote extra staff to managing lift mazes.

- Catamount touts more than $15 million offseason upgrades including two new chairlifts.

- Whitefish Mountain Resort posts updated trail maps showing Chair 8’s new alignment.

- Next year’s new lift at Whitefish will be called the Snow Ghost Express.

- Justin Sibley becomes CEO of Powdr.

- Jackson Hole’s five year roadmap includes detachable replacements for Thunder and Sublette plus a potential a Lower Faces lift.

- Gallix, the Quebec ski area where lift was damaged by flooding, says repairs will cost over CA$2 million. The bottom station of the chairlift has been disassembled and a new rope ordered.

- Poma and the Government of Brazil reach an agreement to reactivate Rio’s longest urban gondola after 5 years.

- The Telluride Daily Planet explains the gondola evacuation process for one of the more complex systems in the country.

- Manning Park says the atmospheric river which caused flooding across southern British Columbia damaged its alpine ski area.

- Big Sky’s Swift Current will open Thursday with Swifty 6 packs of local beer to celebrate.

- Aspen Mountain is finally approved to add a lift in Pandora’s.

- Connecticut’s Woodbury Ski Area is sold with the new owner intending to reopen it.

News Roundup: Race to Open

- Wolf Creek opens tomorrow, Arapahoe Basin Sunday.

- Carrabassett Valley Academy looks to build a T-Bar at Sugarloaf next summer for race training.

- Powdr plans to operate Fast Tracks express lanes at 31 Copper Mountain, Killington, Mt. Bachelor and Snowbird lifts.

- Bogus Basin eyes an expansion to meet rising demand.

- A map shows Sunday River’s Merrill Hill may eventually include a second lift.

- Lots of new trail maps are out: Big White, Crested Butte, Devil’s Head, Keystone, Snow King front and back.

- Under construction Wasatch Peaks Ranch faces a legal challenge.

- The latest Mayflower schedule has the first lift in 2023 with more to follow in ’24.

- Bromley spends over a million dollars upgrading the Sun Mountain Express.

- After four months of work, the Jackson Hole Aerial Tram is back in action.

- Whitefish Mountain Resort previews next summer’s big six pack project.

- A sobering fire update from Sierra at Tahoe acknowledges big challenges and uncertainty surrounding this season.

- Massanutten will build its first detachable quad in 2023, replacing Lift 6.

- The Chamonix Grand Montets cable car, destroyed by fire in 2018, will be replaced with a €110 million 3S gondola featuring stations designed by Italian architect Renzo Piano.

- MMG Equity Partners takes full ownership of Tamarack Resort, buying out two other shareholders.

- Incoming Vail Resorts CEO Kirsten Lynch says lift capacity and speed are key to managing crowding.

News Roundup: October Turns

- Skiing is open this weekend in Alberta, Colorado, Minnesota, New Jersey Ontario and Wisconsin!

- Garibaldi at Squamish releases new renderings of what could be a $3.5 billion project.

- Searchmont holds off on making snow, offering lodging or selling passes and will only install one of the two Skytrac lifts it ordered due to Coronavirus.

- In a rare interview, John Cumming tells the story of Powdr.

- Big Snow and American Dream post promising attendance numbers after reopening.

- The latest capacity management video from SAM and Snow Operating focuses on lift capacity math in the Covid era.

- With two operating and five more under construction, Mexico’s capital region considers building even more urban gondolas.

- The gondola network in Puerto Vallarta appears complete but surrounding theme parks and hotels have a long way to go.

- Skeetawk has a trail map and will open for the very first time December 5th.

- Only one of Shanty Creek Resorts’ two Michigan ski areas will open this winter.

- Following the death of its owner, Granite Gorge does not plan to operate this year.

- Frustrated at lack of investment, local business owners look into buying Mont-Sainte-Anne from Resorts of the Canadian Rockies.

- A three gondola system connecting various points in Park City would cost an estimated $64 million to build with $3.5 million in annual operating costs.

- The Freedom Pass comes back but with fewer participating resorts than in years past.

- With revenue down eight figures, the Palm Springs Tramway takes out a $15 million loan.

- French President Emmanuel Macron orders the country’s ski resorts closed until at least December 1st due to rising coronavirus cases.

- Of 6,521 comments the Utah Department of Transportation received on Little Cottonwood Canyon options, 78 percent were pro-gondola.

- Granby Ranch will reopen under new management December 11th with more than $1 million invested in lift maintenance and snowmaking.

- Soldier Mountain gives another fire recovery update.

- Technical Safety BC releases an incident report and technical analysis from the latest Sea to Sky Gondola incident (both are heavily redacted so as not to impede the ongoing criminal investigation.)

- Camelback’s new Sunbowl Quad nears completion.

Following Cancellations, How Will Lift Construction Recover?

When Vail Resorts spelled out its suspension of operations in mid-March, the shutdown was hoped to last only a week. Fifty days later, all 37 resorts remain shuttered and the company has borrowed more than a billion dollars to weather a possible extended recession.

Almost immediately, Vail Resorts postponed discretionary capital improvement projects including seven new chairlifts. Vail is just one of numerous operators of lifts facing epic challenges due to COVID-19. The impacts trickle down to suppliers, particularly global suppliers of large machinery like the Leitner Group and Doppelmayr. While the two major lift manufacturers are of similar size and structure, their customers are incredibly diverse, from mom and pop outfits to governments, NGOs and Fortune 100 companies.

As regular readers of this blog know, the lift business is not the same as the ski business. Leitner-Poma, Skytrac and Doppelmayr USA have all completed projects for non-ski venues recently such as theme parks, zoos, stadiums and cruise ports. Not only are these projects making up an increasing share of contracts, they tend to be large in scope and often include lucrative operation and maintenance deals. Some of these non-traditional customers are in even worse shape than the ski business, more dependent on high guest densities and air travel. Put another way, there is little chance the Walt Disney Company, Carnival Corporation or the Miami Dolphins would have signed to build their recent lift projects in today’s environment. So-called “point of interest” projects may disappear entirely for a few years.

One bright spot could be urban transport. The Portland Aerial Tram and Roosevelt Island Tramway have both remained operational throughout the pandemic, albeit at reduced capacity (the Portland Tram carries health care workers to three different hospitals and is about as essential as it gets.) Large aerial tramways have been ceding market share to monocable, 2S and 3S gondolas, a trend which will probably accelerate with new personal space concerns. With gondolas, each person or family can take their own cabin unlike on trains or buses. There are lots of great concepts for urban gondolas in North America and infrastructure spending programs could finally get one or two off the ground. Mexico already has a large urban gondola system in operation with two more under construction.